In February 1987, 22 pioneers of cooperation founded the Cassa Rurale di Depositi e Prestiti di Ghedi, giving birth to an efficient tool that helped families and local economy by providing credit at low interest rates, contrasting illegal high interest rates.

In 1964 the new institute, in order to become more functional, more efficient and more useful to its clients, becomes part of the Istituto di Credito delle Casse Rurali ed Artigiane (ICCREA); in 1972 its sister banks of Calvisiano and Fiesse merge into it, and so does the Alfianello bank in 1974.

Since 1990, the bank has undergone a strong expansion, with the quick opening of new branches up to 23 branches, that spread evenly on the area. In 1995, the bank changes its name to Banca di Credito Cooperativo dell'Agrobresciano.

The bank has grown thanks to its attention to social issues, with a special attention to young people, women and local businessmen.

Need

In 2004, BCC Agrobresciano needed to:

- Increase speed in managing communications

- Simplify work flows

- Reduce paper use

- Improve results

Solution

In 2004, BCC Agrobresciano involves PRB in an important Project of organizational improvement aiming at:

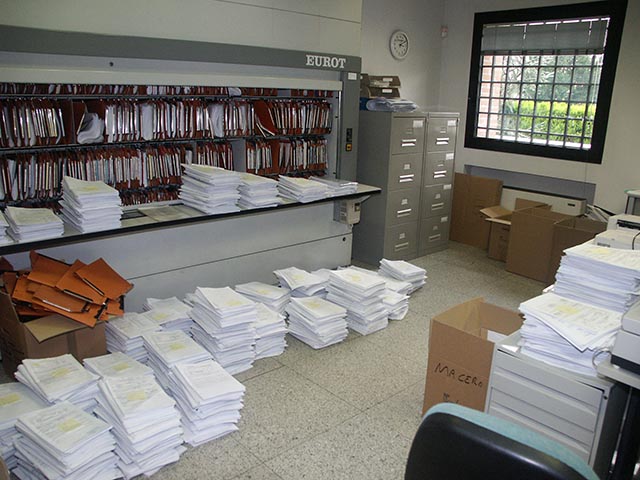

- Digitizing the 6 million pages of Archives

- Managing digital communications

- Making Branch and Operations documents digital

- Digitally managing work-flow with Back Office units

- Digitizing documents in use for Management Processes

- Digitizing documents and work-flow of Accounts Payable and Lawyer's files

- Searching digital documents and messages within the current Management System

- Using Digital signature samples in the Management System

- Integrating digital tools in their Internal intranet, with the aim of creating a unified platform and simplifying user experience

- Disassembling and selling Branch archives

- Re-using office spaces once occupied by archives and cabinets full of documents.

In order to meet these goals, PRB provided:

- Organizational Consulting, based on sound digital experience

- The GDD-Gestione Digitale Documenti® Technology

- Open Channel® control unit for managing messages

- Maxfile® control unit for massive archiving of documents and messages

- Customizations of several organizational flows "ad hoc" designed

- Link of documents and messages to the Management System.

The partnership with PRB is surely a positive experience

GDD: real and measurable benefits, and operational stability

Digital signature samples with GDD

Quick deployment

The quantitative and qualitative goals were reached in just a few months.

Digitization of 6.000.000 pages and disassembly of three bulky archives

Measured results

The results emerge by comparing data in the balance sheets: the improvement of organizational efficiency brings positive effects in unexpected areas.

Hourly operating result: +46%

Interest margin + net commission per employee: +23%

Cost Income Ratio: -25%

Branch running costs: -19%

Long term benefits

On the night of December 14, 2010 an attempt to rob the bank causes the explosion of the ATM: a branch office is devastated. The bank can resume service immediately because all its documents are digitally stored.

Results in short

- Roughly 20 yearly FTE of operational time saved (30.000 hours/year)

- 86% of paper saved in Operations

- Improvement of controls

- Improvement of Governance

- Improvement of Compliance

- Improvement of customer service and speed.

When we realized what we were getting, we knew that this project was absolutely worth doing.

Alberto Loda / Head of Organization, BCC Agrobresciano

Today, GDD follows the user wherever she is

Arturo Marpicati / Head of IT, BCC Agrobresciano